Frequently Asked Questions About RV Insurance

We had a chat with Anica McKesey of Comparion Insurance to ask her all about RV insurance. She’s a licensed insurance broker in the State of California.

What coverage do you recommend for RV owners?

I can take the VIN (Vehicle Identification Number) for any RV and find out all the specs about your RV. The safety features, how much it costs, all the bells and whistles, the length, the width, how many slideouts it has, if it has an awning…EVERYTHING. This is super important because RVs are basically “houses on wheels”. Everyone wants to be assured that this “house on wheels” is covered if something happens to it.

So there are a few things RV owners need to understand first:

Comprehensive and Collision Coverage

The comprehensive and the collision coverage, what people sometimes refer to as “full coverage” (I try not to use this phrasing ever because it’s super misleading), the collision coverage makes sure that whether you have an accident that’s your fault or someone else’s fault and they don’t have insurance, that RV can be repaired or replaced to it’s “like condition”.

Like Condition

I say “like condition” because it could be a 10 year old house on wheels or it could be brand new. All of that is going to determine the value and condition of it. When we say comprehensive and collision deductible, the deductible is the amount that you as the insured, the owner, are responsible for before the insurance kicks in to repair or replace the vehicle.

Deductibles

Old common number deductibles are like $500, or $1000. These days more like $1,500 to $2,500. What that means is you’re responsible for that dollar amount. If you have a $1,000 deductible, anything less than $1,000 in damage means you have to pay for out-of-pocket and cannot file a claim. Anything more than $1,000 the insurance company foots the bill minus the $1,000 deductible. At the end of the day though, whatever the value of the RV is at the time of the loss, is what the insurance company is going to pay.

This is why it’s super important that you write the RV insurance policy the right way. Because, again, all those bells and whistles, the slideouts, the awning, if the inside has been redone, all of that stuff should come up when we pull up the VIN. If it’s an older RV that has been refurbished or has had work done on the inside, it’s up to the owner and the insurance agent to have that conversation so that value is accounted for in the policy.

Anything with wheels in the insurance world is considered a depreciating asset. A lot of people may buy RVs and end up not going on as many trips as planned (and not put as many miles on it). You can buy a 10 year old RV that maybe only has 40,000 – 50,000 miles on it AND THEN completely redo the inside and it still retains a lot more of the value than you would think (compared to when you’re thinking about cars). That’s an important factor. If I don’t know that information, you’re getting the depreciated 10 year old value of that RV like you never did anything to it IF something happened.

PRO TIP: Make sure you tell your insurance agent EVERYTHING you’ve done to your RV so that your policy accurately reflects the true condition and value of your RV.

Does it matter what zip code you live in?

Yes.

Every zip code has a certain amount of losses, claims, etc. and costs the insurance company a certain amount of money. All of that data and information is compiled. For example, Anaheim Hills may have more fires than another area. Or LA County has far more claims, losses and insurance fraud than perhaps Orange County. Those zip codes are going to reflect that when it comes to the pricing of insurance.

When you think about how some areas are more densely populated or have more traffic and people, more consumers in general, your odds of being in an accident in places that are more densely populated are way higher than if you reside in a rural area.

Does RV insurance cover forest fires? For example, one might go camping and their RV may get damaged in a forest fire.

Collision coverage is if you collide with another vehicle or object. Comprehensive is everything else. And truly everything else. So fire, theft, flood, vandalism, random acts of God (where a tree might fall on your car). Everything else is included in the comprehensive coverage.

It does depend on the company. If you’re in another state, some policies don’t apply. For the most part, it’s comprehensive coverage and your comprehensive deductible will apply.

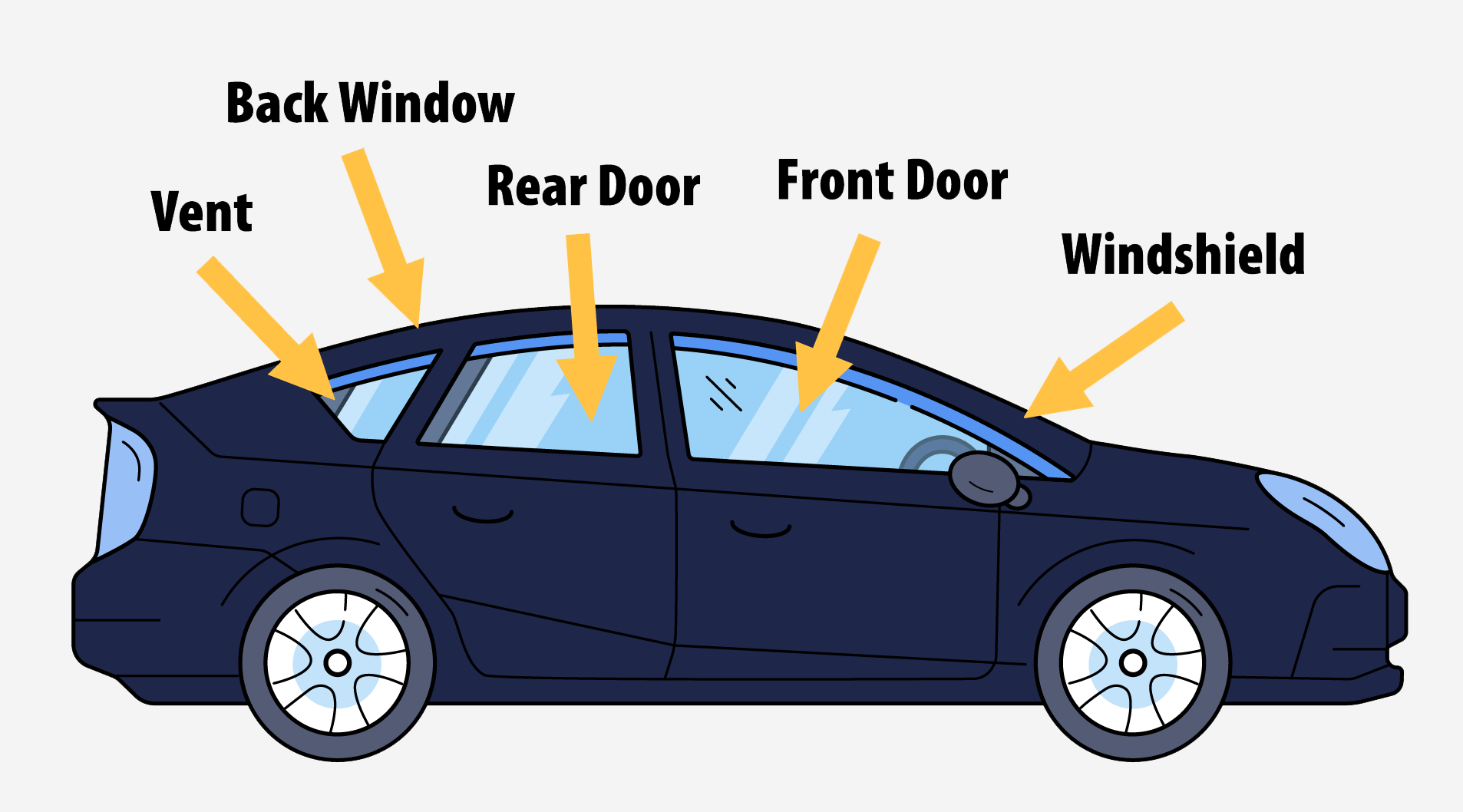

Do most RV insurance policies cover broken windshields?

It depends on the company.

Broken glass repair would normally be covered by comprehensive coverage. However, it does depends on what your comprehensive deductible is and then the insurance kicks in. There are a few companies that completely cover glass where no deductible or out-of-pocket cost applies, while most other carriers will require your comprehensive deductible to be met first.

Let’s say you go camping and a bear rips open the door to your RV to get to your food. That would be covered by comprehensive?

Yes. That’s comprehensive.

If you never drive your RV is there a good option for you to save money like a MetroMile type of thing?

It gets really tricky. I advise my clients to try to gauge how much mileage they drive in a short span of time, like a 30 or 60 day window of regularity – and also an annual span of time. A lot of people work remotely now. There might not be a need for a daily commute on their actual vehicle. But they might decide to go up the coast to get out of the house one week. It might be something that happens once or twice a year.

With RVs, it’s the same thing. We know that no one is commuting daily in an RV. But when you first get it, it’s like a new shiny gem. You might go on a monthly road trip and then it tapers down and because you haven’t used it for a while, it becomes something like “we’re going to go somewhere for 2 weeks” (somewhere far)…you have to average that out to be able to justify the mileage to the insurance company.

Now, because insurance companies are so strict, I have several companies that want to see pictures of the odometer. If you don’t have a way to prove the date, then it’s just a picture of the odometer today and then a picture of the odometer again in maybe August 16th. Then a picture of the odometer again on Feb 16th. And then they determine your mileage that way.

But yes the number of miles you drive directly affects your insurance rate. Driving record, years of driving experience, zip code and mileage are all huge rating factors.

Do most RV insurance policies cover burglary or break-ins?

Yes. Also comprehensive coverage. So that can be vandalism, theft, it’s just subject to your comp deductible.

Website: comparioninsurance.com/anicamckesey

LinkedIn: linkedin.com/in/anicamckesey/

Instagram: @anicamckesey